20+ mortgage gift rules

Web When borrowers accept and apply gift funds for a mortgage down payment mortgage gift letter must be included in the loan file. What are mortgage rates today.

Down Payment Gift Rules From A Friend Or Relative

Web The IRS currently gives people a lifetime gift exemption of up to 114 million which applies to any gifts you make over the course of your lifetime.

. Gift funds can also be used to pay for closing costs which average between 2 and 6 of your loan amount depending on your loan amount. Before you borrow check mortgage rates in your area. Anytime you gift more than 15000 for.

However gift letters that involve a gift of more than 16000 will likely be reported to the IRS. Relationship Between Borrower and Donor. However things are much different today than they have been in the past as FHA loans and other proprietary mortgages often have much lower down payment requirements.

Thats just the annual exemption. Down payments exceeding 20 may be paid totally with gift money. Web As a general rule lenders will want you to explain any gift you receive thats over half the value of your total household monthly income.

But that doesnt mean the donor will pay taxes. Web There are 108 banks in the Russell 3000 Index RUA that had total assets of at least 100 billion as of Dec. FactSet provided AOCI and total equity capital data for 105 of them.

This means that the gift limit for the FHA loan is 35 of the house price. Here are the. The remaining percentage can be paid with gift money.

It also sets a lifetime exemption that is free of gift tax. For example if you earn 4000 a month from your salary your lender will want you to explain any gifts you receive that are more than 2000. Web You must guarantee the gifter has no legal right to the property.

Web Down payment amounts above 15000 and received as a gift must be reported on a gift tax return by the person making the giftnot the beneficiary. All mortgage programs require signed gift letters. Web The minimum down payment allowed for FHA loans is 35 and the borrower is allowed to pay the whole down payment using the gifts.

Thats because any gift below the 16000 limit will not incur the gift tax. Web When making down payments of less than 20 gift-recipient home buyers must pay at least 5 of the sale price with their own funds. If you put down less than 20 be prepared to chip in some of your own funds toward the down payment.

If the property being purchased is a duplex triplex or four-plex. Web Federal tax law sets a maximum amount that a donor can give per year without incurring gift tax liability known as the exclusion amount. The remaining 15 can be paid with gift money.

Web Whether or not mortgage gift money gets reported to the IRS will depend on how much you receive. Web For 2020 the IRS gift tax exclusion is 15000 per recipient. Looking to qualify for an FHA loan.

You must provide proof your deposit is a gift Before accepting a gifted deposit your lender will want the gifter to declare in writing that its a gift with no obligation for repayment. In addition to the 16000 annual exclusion some donors may need to be mindful of the 12060000 lifetime gift tax exclusion limit set according to IRS Estate Tax for 2022. Most home buyers interested in using an FHA loan come up with at least 35 down from their own funds.

That means that you and your spouse can each gift up to 15000 to anyone including adult children with no gift tax implications. Low-down-payment mortgages and gifts. It is important to note that this limit provides information about how much funds can be disclosed as a gift.

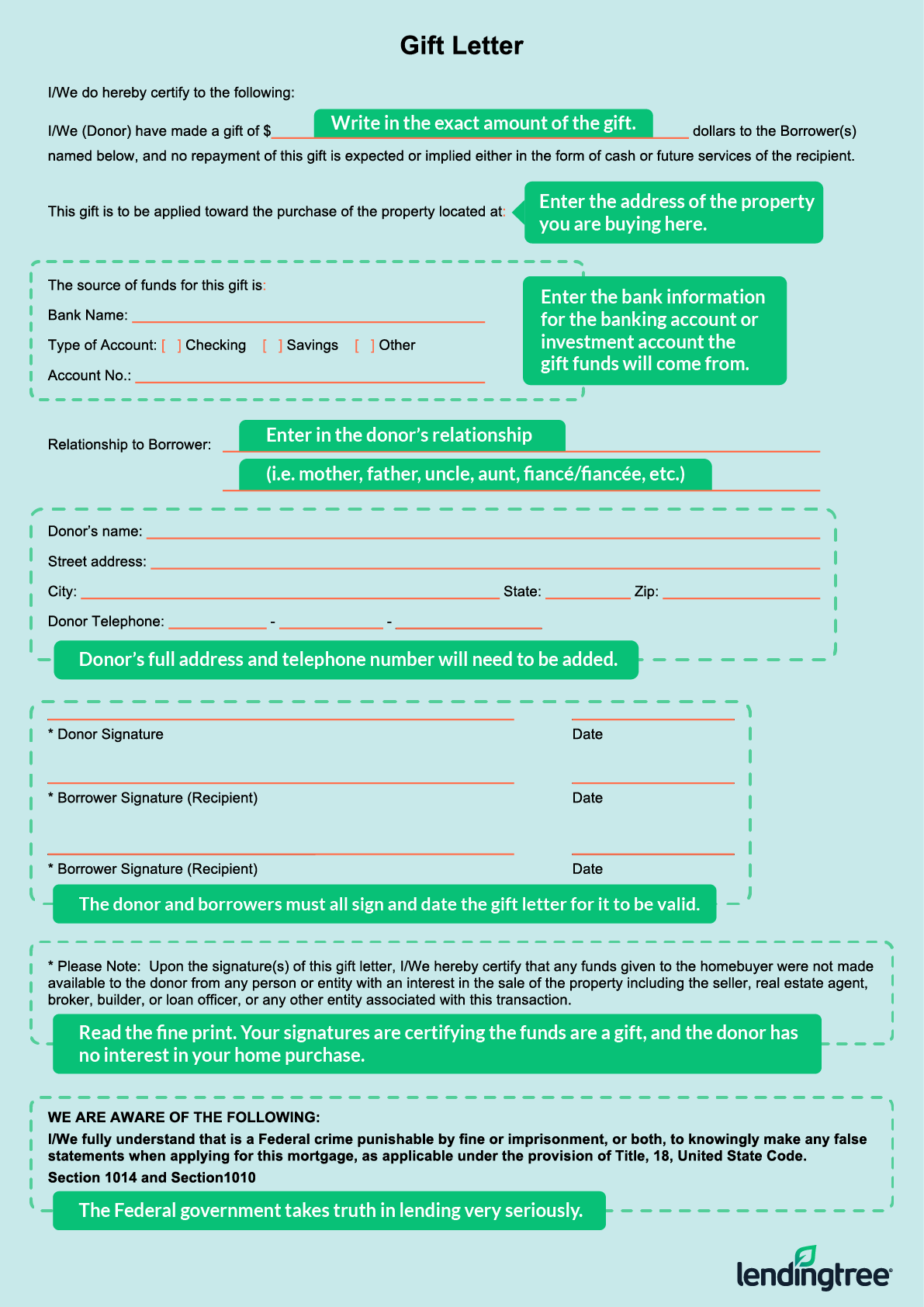

Web The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Web The letter must explain who is gifting the money where the donors funds are coming from and the relationship between the donor and the recipient. Web By a tax rule known as gift splitting married couples can gift up to 32000 in 2022 or 34000 in 2023 to another person without liability as well.

Web For a gift that exceeds that amount the donor must file a gift tax return to disclose the gift. Its the affidavit signed by both the donor s and borrower s stating they have followed the rules. As of 2022 the annual gift tax applies to amounts over 16000 meaning that any gift lower than that will not incur the federal gift tax and does not need to be reported to the IRS.

The borrower doesnt need to add any money out of pocket if the gift amount covers the entire 20 of the home purchase price. Web When making down payments of less than 20 gift-recipient homebuyers must pay at least 5 of the sale price with their own funds. If you put less than 20 down at least 5 of your down payment would have to come from your own money if its a.

Web When it comes to home buying 20 or higher is the standard mortgage down payment size that most lenders would ideally prefer. The tax applies whether or not the donor intends the transfer to be a gift. While it may seem a bit confusing at first your initial understanding is correct.

Web If the gift amount is less than 20 of the purchase price of the home. Web Youll need to put down at least 20 if you want your entire down payment to be gifted money. Web If its a single-family home the down payment can also be gifted in its entirety.

Web A mortgage gift letter that shows a gift of less than 16000 might not be reported to the IRS. Down payments in excess of 20 may be paid totally with gift money. The annual exclusion amount for an individual taxpayer is 15000 in 2021.

If your child purchases a home with a spouse or fiancé you and your spouse could each gift up to 15000 to the buyers for a total of 60000.

Wedding Gift Money Online Website Save 49 Jlcatj Gob Mx

What To Consider When Using Gift Funds For Your Down Payment On A Mortgage Mybanktracker

Mortgage Down Payment Gift Rules Financing Fundamentals

What To Know About Mortgage Gift Letters Trusted Choice

Mortgage Gift Letter Guide Requirements Free Template

Mortgage Women Magazine 2022 Issue 2 By Ambizmedia Issuu

Clark Howard S No Gift Card Gift Certificate

20 Obscure And Overlooked Tax Deductions Credits And Benefits Henssler Financial

Flussdiagrammvorlagen Design Tipps Und Beispiele

How To Complete A Gift Letter For A Mortgage Lendingtree

424b4

The World 12 20 2017

Everything You Need To Know About Down Payment Gifts Smartasset

5 Guidelines For Homebuyers Using Gift Money For Down Payments

:max_bytes(150000):strip_icc()/fhaloan.asp-6b3a202ce0bb4040937398e14ffe943d.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

How To Use A Gift Letter For Your Mortgage Better Better Mortgage

Fha Loan Rules For Down Payment Gift Funds